The best blockchain is the one nobody notices

By Asgeir Sognefest, dOrg Builder & Founder of Kiip

In 2014, I was writing my master’s thesis on predicting Bitcoin prices with neural networks. The complexity was the point back then. It was a frontier for hackers and idealists. But I’ve spent the last decade realizing that what worked for the frontier is fatal for the mainstream.

For the last few years, my work has focused on a single philosophy: The best technology is invisible.

Users shouldn’t need to understand wallets, gas fees, or seed phrases to benefit from blockchain. If your user has to “learn Web3” to use your product, you have already failed.

We are finally at a point where we can replace banking rails without burdening users with crypto bloat. Here is how we build invisible infrastructure.

The problem: You are staring at the plumbing

When you send money on Venmo or use a Visa card, you never ask: “Is this settling via an ACH batch or a SWIFT transfer?”

You don’t care about the plumbing. You care about the result: Did the money arrive?

For ten years, Web3 builders have forced users to stare at the pipes. We made them manage connection protocols (wallets), pay for the transaction fuel (gas), and navigate routing logic (bridging). This isn’t just bad user experience; it’s a dealbreaker for mainstream adoption.

To cross the chasm, we must treat blockchain exactly like we treat TCP/IP: as an invisible infrastructure layer. The end user should see “USD Balance” and “Send Money.” The fact that the value moves via stablecoins on a decentralized ledger is an implementation detail, not a feature.

The business case: Why swap the backend?

If the user shouldn’t see the blockchain, why use it at all? Why not stick to Stripe or SWIFT?

The answer isn’t “decentralization” as a buzzword. It’s efficiency.

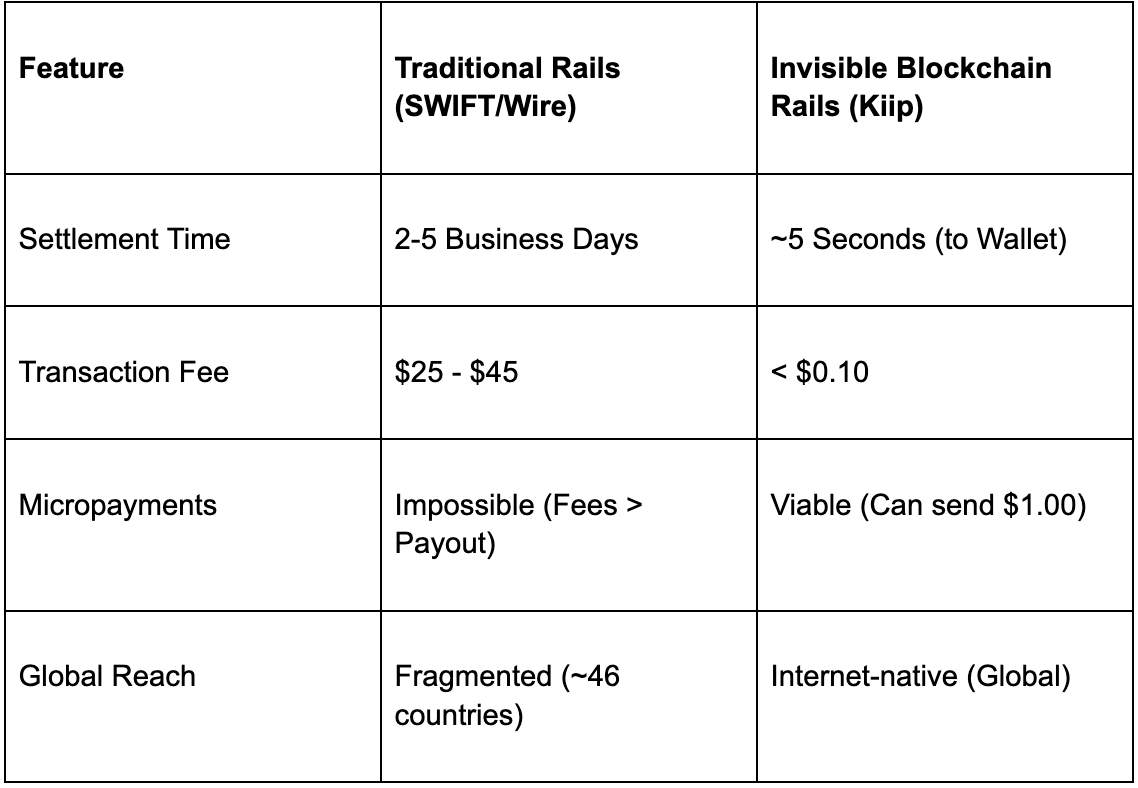

Traditional banking rails are built on infrastructure from the 1970s. For a global platform, this creates friction that kills margins.

Here is the concrete difference we see at Kiip when sending a $50 payout to a freelancer in the Philippines:

Incumbents are excellent for the US and EU. But for the Global South, LATAM, and Southeast Asia, old rails fail. By swapping the backend, a platform instantly expands its addressable market to anyone with an internet connection.

Killing the external wallet

The biggest friction point has always been the external wallet (e.g., MetaMask).

Asking a normal user to install a browser extension, write down 24 words, and fund a wallet just to receive a payout is a non-starter. It destroys conversion.

At Kiip, we leverage the modern stack (account abstraction) to build integrated wallets. This is “non-custodial” (the user owns the funds) but “invisible” (it feels like a Web2 app). Kiip even abstracts away the complexities of blockchain for developers integrating Kiip.

Here is the stack that makes the technology disappear:

1. Identity: Passkeys over seed phrases

We replaced the “seed phrase” with passkeys (WebAuthn). Users create a cryptographic key pair using the secure enclave on their device (FaceID, TouchID).

The User Experience: “Scan face to login.”

2. Smart accounts (ERC-4337)

Instead of standard “EOA” wallets, we deploy smart contract wallets. This separates the “signer” (the passkey) from the “account” (the contract).

At dOrg, I spent two years building Zodiac modules for Safe - parts of a infrastructure that now secures over $100 billion in assets. That work taught me what’s possible when you decouple identity from accounts. We can program recovery logic directly into the wallet. If a user loses their phone, they don’t lose their money. Social recovery solves the “lost keys” nightmare that has plagued crypto since the beginning.

3. Gas abstraction (paymasters)

In a standard crypto transaction, you need ETH to pay for gas. This is a massive hurdle for a user who just wants to receive USDC. We utilize paymasters - smart contracts that sponsor gas fees.

The Result:

The platform treats gas as operational overhead (like AWS server costs). The user interacts purely with their balance, never realizing a blockchain fee was paid.

The reality check: The last mile

I’m a pragmatist. I know that instant settlement on-chain is useless if a user in Brazil can’t buy groceries with it.

This is the “last mile” problem.

While the blockchain backend handles the global movement instantly, we must integrate with local payment rails (PIX in Brazil, SPEI in Mexico, SEPA in Europe) for the final step.

This is where the “crypto anarchist” dream meets reality. To build this, you need strict adherence to KYC and AML laws. We ensure that while the transport is decentralized, the exit points are compliant. This hybrid approach is the only way to build sustainable infrastructure.

The invisible future

We built Kiip to prove this architecture works.

The Old Flow: Install MetaMask → Write down seed phrase → Copy hex address → Receive funds → Find exchange → Sell tokens.

The Invisible Flow: Click link → FaceID → See USD Balance → Withdraw to Bank.

We are moving away from “crypto apps” defined by their friction. The best blockchain applications of the next decade won’t look like blockchain applications at all. They will simply be better, faster, cheaper apps that happen to run on chain.

The technology is finally good enough to disappear.